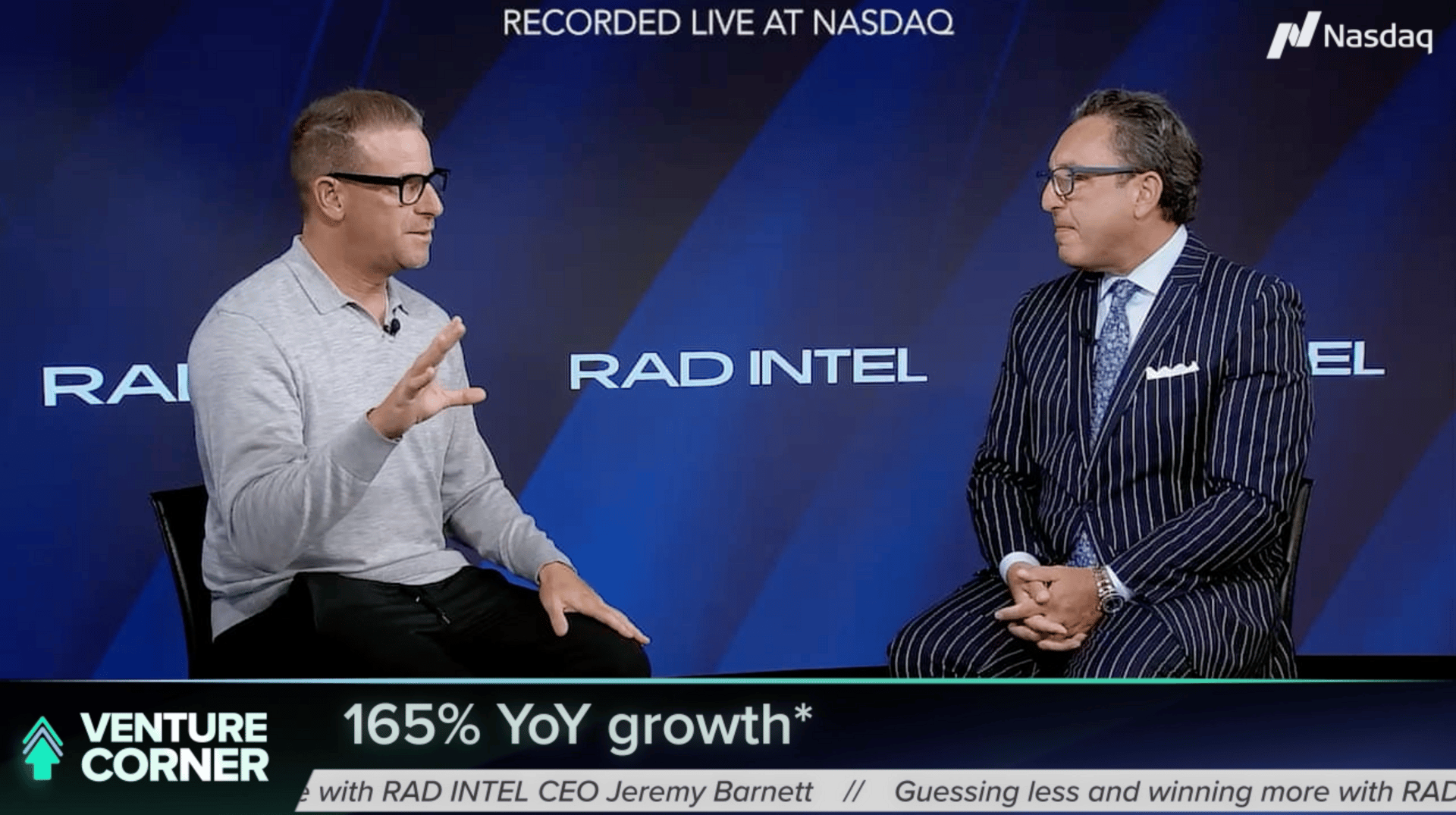

Last Call Before the Surge

$50M+ raised. 10,000+ investors. Valuation up 4,900% in 4 years*.

Shares are just $0.81.Nasdaq ticker $RADI reserved. Backed by Adobe, Google, Meta, Amazon insiders. 225+ M&A deals executed by leadership.A who’s-who roster of Fortune 1000 clients and agency partners recurring seven-figure partnerships in place.

Fast Company calls RAD Intel “A groundbreaking step for the Creator Economy.” Sales contracts are already 2.5X in 2025 vs. 2024.Industry consolidation is red-hot: 240 AI deals worth $55B in 6 months. AdTech market: $795B in 2025.

Companies scaling AI expect 60% higher revenue growth over the next 3 years.This is the layer powering tomorrow’s marketing giants — and your last chance to get in at this price. Secure your allocation, diversify your exposure, and participate in RAD Intel’s upside while the window is still open.

What Changed?

Retail spending has been resilient for years. But momentum is softer now.

A slowdown is beginning to emerge beneath the headline numbers. Credit card debt is climbing, with low-income consumers under the most strain. Delinquencies are rising, and personal savings rates are starting to slow.

What had kept the US economy moving during the past few years was pandemic savings, wage gains, and strong job growth. But those tailwinds are now fading.

The Numbers

Household borrowing: American total household debt rose by $197 billion in Q3 2025. It now stands at a high of $18.59 trillion. – Federal Reserve Bank of New York, September 2025

Past-due bills: Delinquencies on credit card loans hit 3.05% in April 2025. – Trading Economics, November 2025

Historical delinquency rate: Credit card payments overdue by over 30 days were 1.53% post-covid, sitting at a record low in July 2021. – Trading Economics, November 2025

Household savings: Personal savings slowed to 4.6% in August, down from its pandemic-era peak of 31.8%. The saving rate has declined for four straight months. – Trading Economics, November 2025. Bureau of Economic Analysis, August 2025

Why It Matters

With October layoffs being higher than expected, economists at The Bank of New York Mellon note “raising concerns that growth could slow” in response. This is a real problem because it’s this group that is the backbone of economic growth in the US. The Bank of New York Mellon (BNY) confirms this, reiterating the importance of consumer spending as “an important barometer of consumer health”. Another issue? Consumers don’t have their pandemic-era savings to fall back on anymore either. They had depleted these by the spring of 2024. Now, lower-income Americans have little cushion left for spending. That’s part of the reason why real consumer spending growth has become modest and volatile. Real personal consumption expenditures continue to grow, but at a sluggish pace compared to prior years. Especially the post-pandemic boom in 2021. Morgan Stanley anticipates that the trend will continue, ultimately weakening “through the rest of the year and into 2026 as households feel the effects of tariffs and economic uncertainty.”

GDP implications: As BNY points out, “consumption comprises 70% of gross domestic product (GDP), and a softening labor market could potentially subdue spending.”

Effect on consumers: The “affluent will carry consumer spending,” according to Morgan Stanley, as lower-income consumers tend to feel the impact of a cooling labor market first.

Corporate earnings risk: A slowdown in consumer spending will impact overall growth. And in turn, earnings forecasts. Companies with exposure to retail services and discretionary products could face headwinds. They are likely to underperform as a result. A broader consumer pullback could pressure revenue forecasts, margins, and ultimately valuations.

Expectations for holiday sales are lower this year due to the pressure of US tariffs. This could add fuel to the fire, causing additional earnings strain for corporations.

What to watch for: As we get more information about the US labor market following the government shutdown, take note. Any rise in unemployment can amplify consumer stress as it pressures the pocketbook even further.

Takeaway

With savings depleted, debt rising, and delinquencies climbing, households have far less room to absorb new shocks. As consumer spending cools, GDP is likely to also. And earnings expectations will have to adjust with it.

For investors, the story heading into 2026 is simple: their cushion is now gone.

— Lauren Brown

Editor, American Ledger

Sources:

Federal Reserve Bank of Boston, August 2025 https://www.bostonfed.org/publications/current-policy-perspectives/2025/why-has-consumer-spending-remained-resilient.aspx

*Disclaimer: This is a paid advertisement for RAD Intel made pursuant to Regulation A+ offering and involves risk, including the possible loss of principal. The valuation is set by the Company and there is currently no public market for the Company's Common Stock. Nasdaq ticker “RADI” has been reserved by RAD Intel and any potential listing is subject to future regulatory approval and market conditions. Please read the offering circular and related risks at invest.radintel.ai.